How payment flexibility can be crucial for increasing conversions, AOV and serving international markets

Today’s omni-channel customers want flexibility and choice when they pay for items online. One element of that flexibility is offering customers a number of different payment options such as credit/debit cards, on account, by gift/e-gift card, by invoice, by bank transfer or BACS, or on finance/‘bill me later’ services etc…

Whilst it would be great for customers to have as many ways as possible to pay, it’s unrealistic for merchants to cater for all forms of payment for all types of customer. The popularity of those services varies widely between different business types and different countries, so you may find that if you trade internationally, or open up new channels in different markets, it’s important to understand local preferences as there are often significant differences. Let’s examine some of the options that merchants can provide for their customers in terms of payment type, which are most popular, and which markets they are most common in.

Credit/Debit Card

In Western Europe, it’s very common to pay with credit or debit cards for online purchases so these are definitely payment methods that you should be supporting. They allow customers to charge their purchases to a credit card using the services of an online payment processor such as TRU\\ST Payments or CyberSource. The customer fills in their credit card information on a payment form on your website that is securely transmitted to the payment processor. The payment processor collects the funds and then sends them to the merchant minus their transaction fees. These fees vary from one processor to another so it’s good to compare different providers to find the best deal for your business.

Debit cards are also very popular so should also be catered for. Using a payment processor, they directly draw cash for a purchase from the customer’s bank account and transfer it to an account held by the vendor. The payment processor will again charge a fee for providing this service. Credit and debit card payments are widely used across sites in the UK, Europe and further afield so merchants should definitely provide them.

PayPal

PayPal is an acquirer, performing payment processing for online vendors, for which it charges a fee. The fees depend on the currency used, the payment option used, country, amount, volume of transactions etc... Online money transfers serve as electronic alternatives to paying with traditional methods, such as cheques and money orders, but PayPal also processes credit/debit card payments alongside it’s money transfers. Widely used across the UK and Europe PayPal is another option merchants should definitely consider offering.

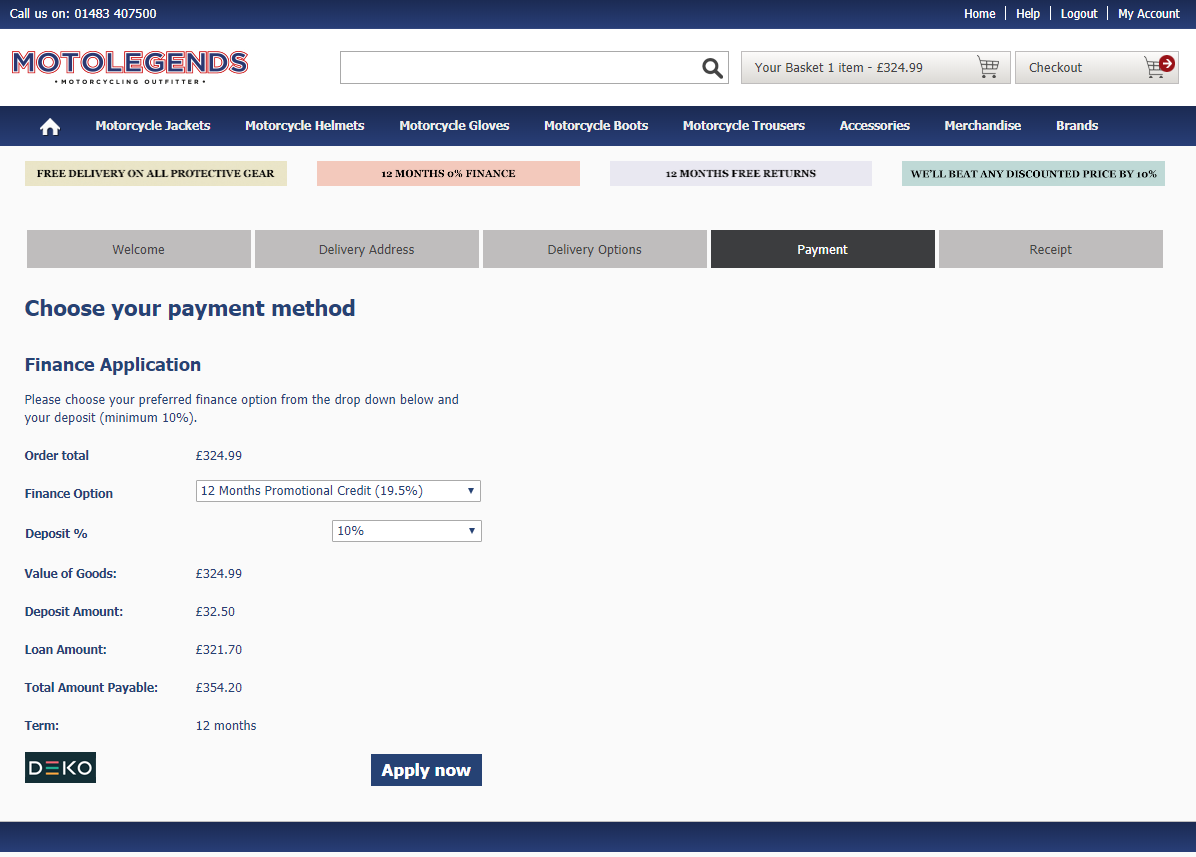

Financing: Instant credit, Buy now - pay later/Bill me later

Retail finance, instant credit, buy now - pay later or ‘Bill me later’ services like Klarna, Deko Pay, V12 or PayPal Credit offer shoppers, as the name suggests, the ability to buy items immediately but pay for them later. They offer flexibility and convenience to the user but also pose no risk to the merchant, with any risk taken by the credit provider. The merchant gets paid at the time of purchase same as with most other forms of payment. Some larger merchants may choose to offer their own in-house financing services but it’s more common for them to use a 3rd party retail financing programme like those listed above. Merchants will again pay a fee to the financing company for providing these services.

For example, Motolegends offer its customers the ability to pay for items on finance using Deko Pay. A customer selects a repayment option and deposit amount, and the payment structure is outlined to them. They can then choose to submit a credit request at those terms and are redirected to Deko Pay to complete their application. If approved, their order will be placed and the payment is processed by Deko Pay. The merchant is paid in full by Deko Pay and any customer contract for repayment stays with them, rather than the merchant.

In the UK, offering finance/instant credit tends to be more popular for higher value items and usually requires a minimum purchase amount. The upside for merchants is that offering finance payment options can help encourage shoppers to buy higher ticket items leading to larger average order values. Favourable or interest-free credit terms can also help to convert and increase AOV. However, as with many of these payment methods, there are huge variations in popularity between countries. For example, ‘bill me later’ services from providers like Klarna which offer customers interest-free installments for repayment are a really popular form of online payment in Germany and Scandinavia. It probably depends what you sell and where you sell it as to the benefits of offering third party finance schemes, but they should definitely be considered for high-ticket items and if trading in certain countries.

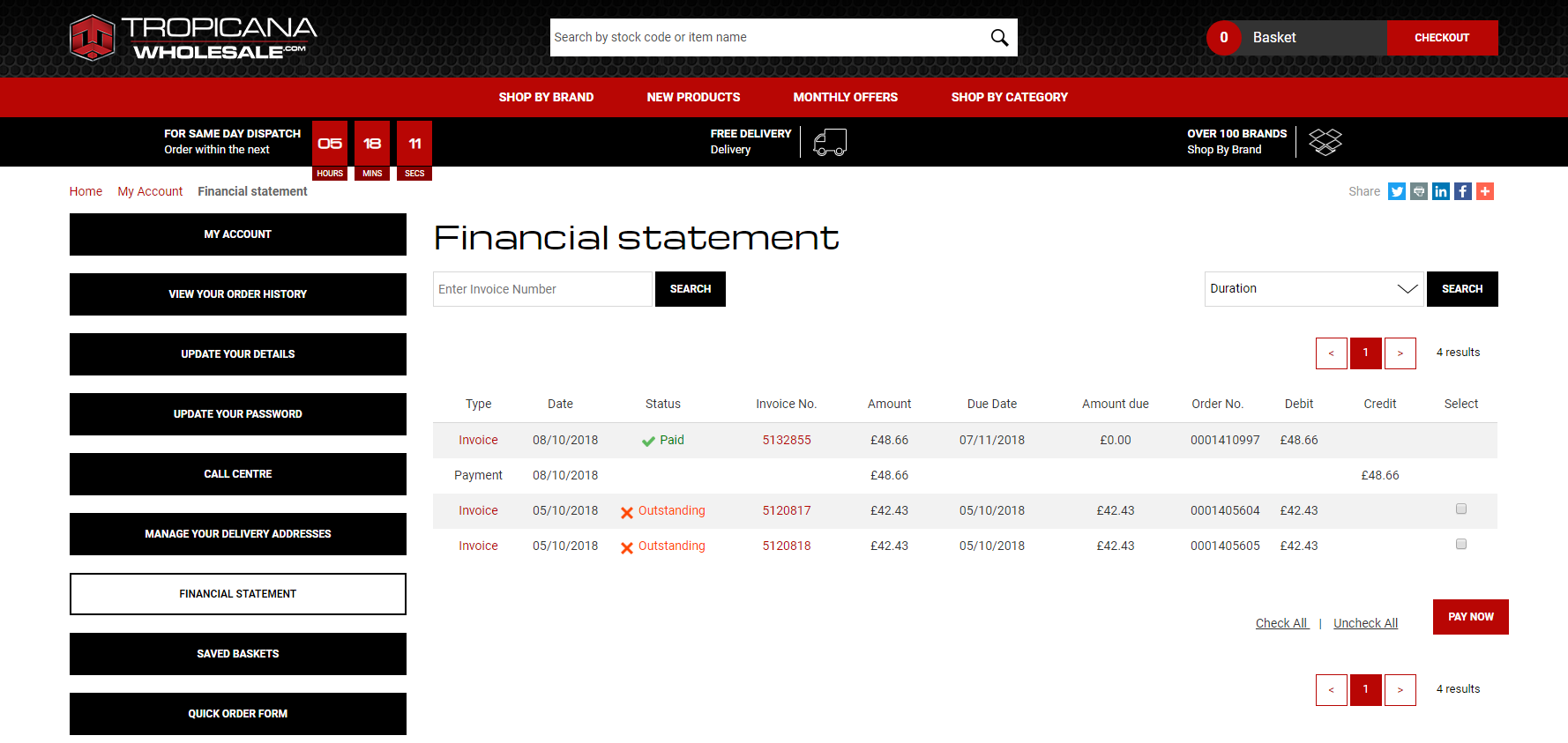

Credit Account

Paying by credit account is very common in B2B ecommerce and is likely to be the preferred payment method for customers buying from the trade who have a pre-arranged line of credit with customers. It is a form of finance but all the risk tends to lie with the merchant as no 3rd parties are involved. For example, Tropicana Wholesale are the UK’s leading sports supplement distributor selling products into gyms, hotels, sports supplements stores and personal trainers. They extend credit terms to some of their customers meaning they can place orders online and pay at a later date. The credit terms (usually within 30 days), payment dates and invoices are all viewable in detail online, and invoices can even be paid via credit/debit card online (or by other means) to free up available credit.

Whilst almost exclusively used for B2B ecommerce in the UK, pay by invoice is the most popular form of online payment to retailers in Germany, where customers order online and only pay the invoice for their goods once they have been received. These services will be offered using a third party service like Klarna, who bear all of the risk, but charge a fee to the merchant in return for that. Offering payment by invoice through a third party provider like Klarna or BillPay is therefore essential if you are trading in Germany as most of your customers would expect it.

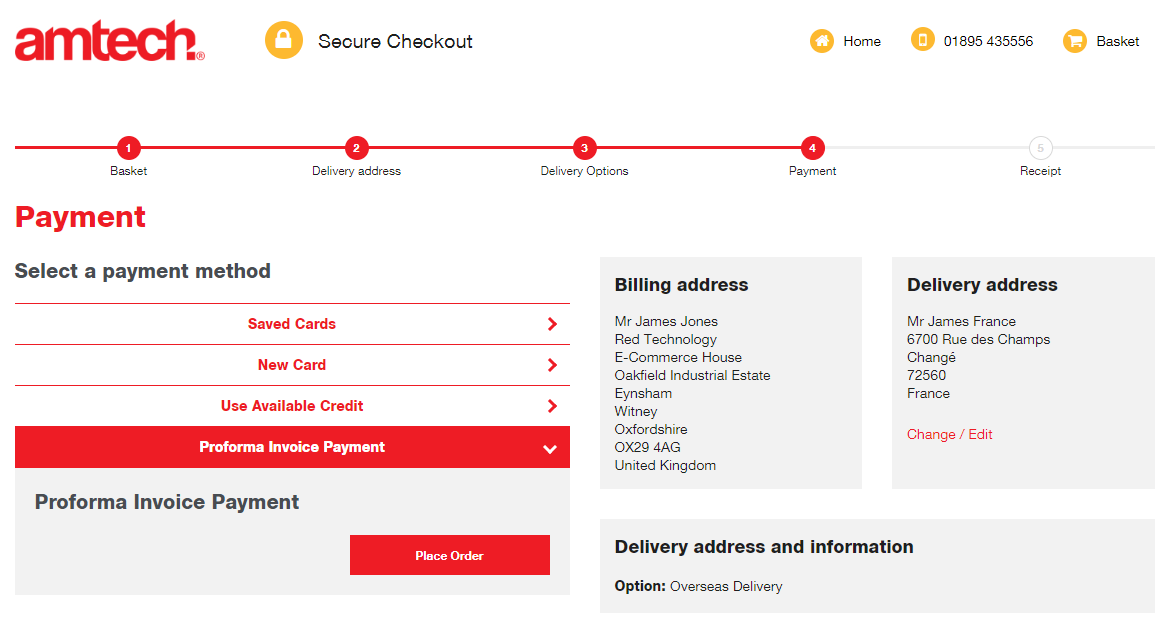

Proforma Account

For customers who merchants don’t extend a line of credit to, proforma invoices are another possible payment option, particularly in B2B ecommerce. When using proforma invoices, customers order items online and are then invoiced for the goods. Only when the invoice is paid are the goods are released and sent, so whilst the order is placed online, the payment might be carried out via a different channel. Another option worth considering, although definitely more common and suited to B2B ecommerce.

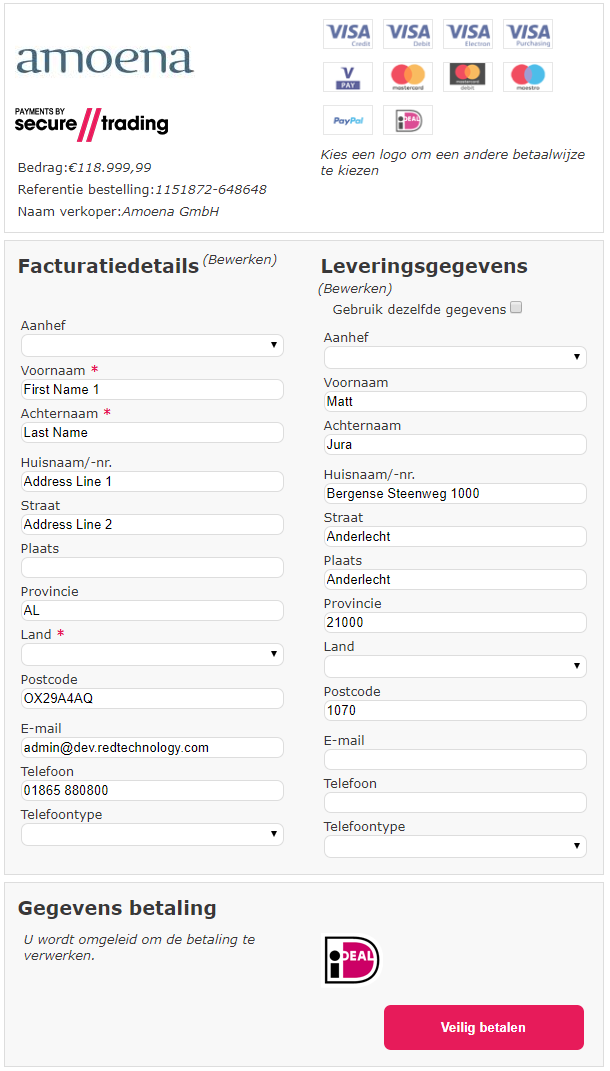

iDEAL

Whilst barely used in the UK, in the Netherlands 84 percent of citizens use the national payment method iDEAL for online purchases. iDEAL is a direct online transfer from a customer’s bank account to the bank account of the merchant, although sometimes these transactions are facilitated by a CPSP (Collecting Payment Service Provider) on behalf of the merchant.

For example, Amoena have numerous international channels but on their Dutch channel they offer iDEAL as a payment method due to its popularity.

If you are looking to trade in the Netherlands, then it’s vital to ensure you accept iDEAL as a payment method. If not, it’s unlikely to be worthwhile offering it.

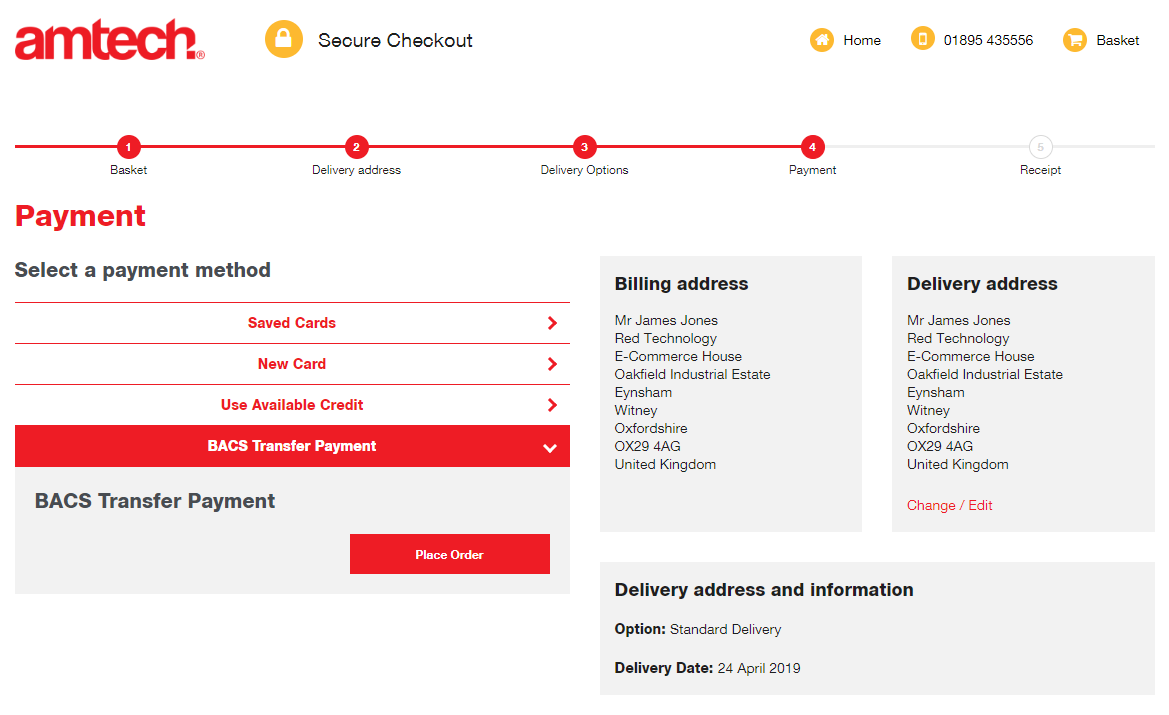

Bank transfer/BACS

Not very common for online transactions in the UK, although some B2B sites use them. For example, DK Tools give customers the option to place orders online and checkout using BACs as the preferred payment method. Once the payment is received, the merchant can then ship the goods. It’s an easy way to get money straight to your bank account without the additional fees that a payment provider or acquirer charge. Some merchants offer this option to overseas customers to ensure they don’t incur currency exchange fees and are paid in full before releasing any goods.

Despite it’s lack of popularity in the UK, merchants looking to trade in Germany should definitely consider bank transfer as it’s one of the most common payment methods there. Bank transfer is often also used as a form of payment following a pro-forma or account invoice, though this isn’t carried out via an ecommerce site directly either.

Gift Cards/E-Gift cards

Two types of gift cards are common: store-specific gift cards and those issued by gift card companies like One4all or Love2shop that can be used across a host of merchants. Offering customers the ability to use generic gift cards gives them flexibility but tying them to using giftcards issued exclusively by you means that they have no choice but to spend them with you. Running your own gift card or e-gift card programme is a good way to drive loyalty but obviously requires more administration and possibly costs but there are third parties that can do this for such as GiveX. There would be a fee involved in using another company to run your gift card programme but it is likely to be far less work than trying to run your own gift card scheme. Only a very large retailer is likely to consider running their own scheme.

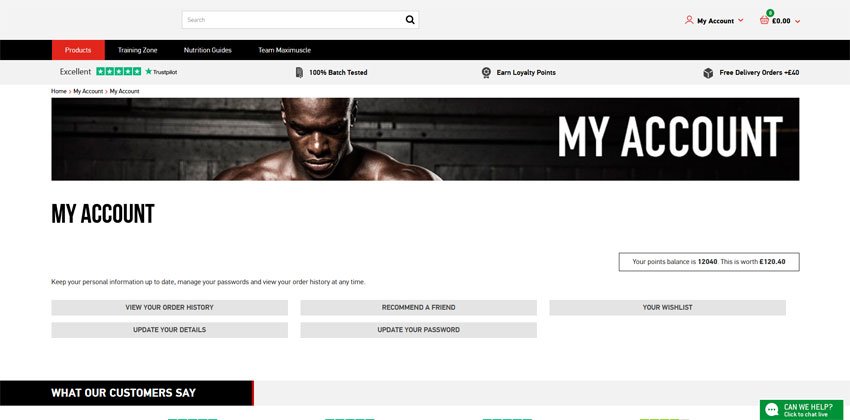

Loyalty Points

Depending on the make up of the programme, loyalty points can be another form of online payment where users build up a balance of points that are converted into a cash value that can then be used as payment, or part payment, of their order. Merchants can determine the value of points earned and redeemed and the expiry date of any such points.

tradeit features its own built-in loyalty scheme meaning that merchants can launch their own loyalty programmes with ease. Maximuscle use the scheme to power their online rewards programme, MaxiRewards, with any eligble orders earning points which are stored against the user’s online account and displayed alongside their cash value. Users can then use that cash as payment, or part payment, on any future order.

Digital Wallets

Digital Wallets are growing in popularity with the backing of major companies like Apple (Apple Pay), Google (Google Pay) and Samsung (Samsung Pay) amongst others. Customers store credit/debit cards and loyalty cards on their devices and can make secure, streamlined purchases online more quickly and/or on the move with a smartphone using technology like finger print readers or facial scans for authentication. PCs, Laptops or tablets running the related hardware and browser can also support these payment but they tend to be proprietary. Merchants will pay a similar (or the same) fee as they would if using a payment processor and some of the payment providers offer these digital wallets as an AMP (alternative payment method) through their own product meaning merchants can provide these payment options to customers but only deal with a single payment processor. Digital wallets are growing in popularity so are definitely worth considering as an option for your customers.

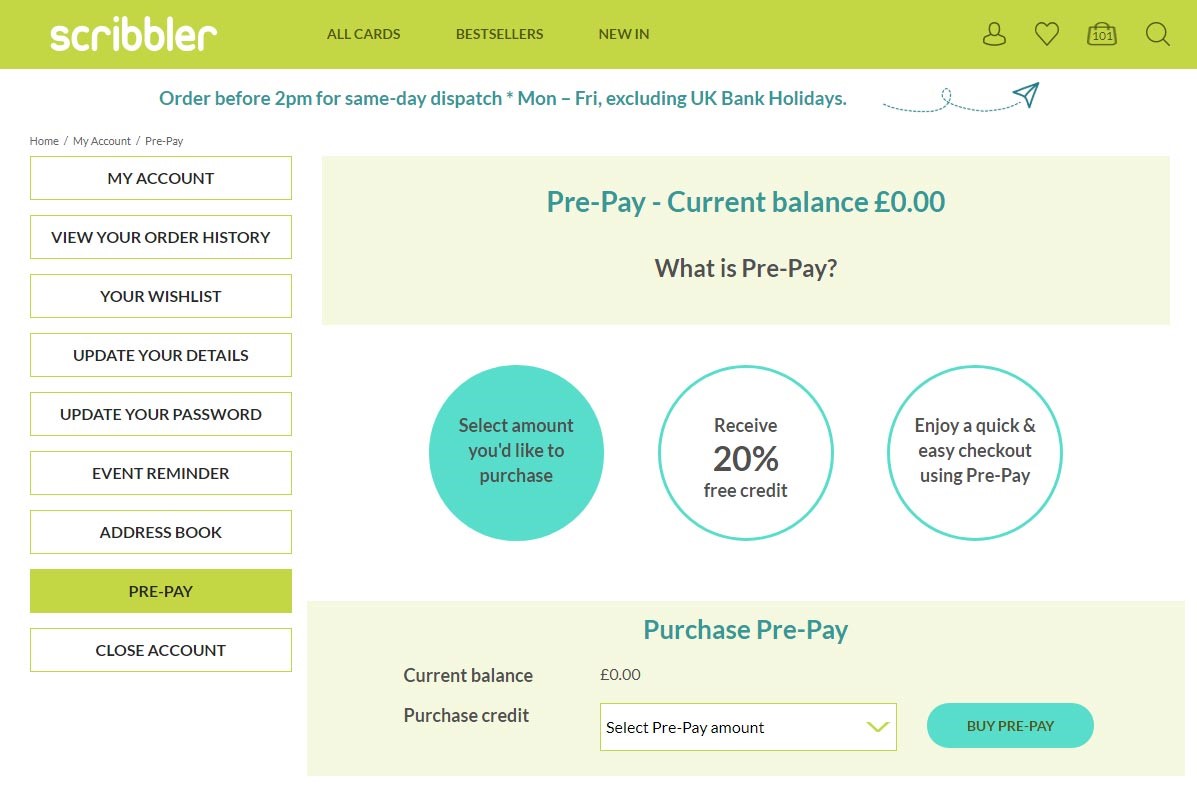

Pre-payment/Pre-paid Credit

Pre-payment is another form of payment method which can be used online. Customers have the option to buy credit (with their preferred form of payment) which is stored against their account, usually at a discounted rate from the merchant, that can then be used to pay or part-pay for future purcahses. Whilst it might cost the retailer money to offer the service, it insures their loyalty by making sure the money is spent with them. It’s especially effective for retailers selling items that are or could be regularly purchased such as FMCG, health & beauty products, gifts, fashion, entertainment and more...

For example, the card & gift retailer Scribbler offer their customers a 20% bonus on any credit that they buy in advance, so a customer who buys £100 of credit actually receives £120 to spend in future. This credit is then stored against their account, meaning that they can pay for future orders with that cash. Not only does this help them to generate cash in advance, but also ensures that rather than just buy things from whichever retailer offers them the best price at a particular time, they are obliged to continue to buy things from them as they have that pre-paid credit. This helps Scribbler to garner loyalty as those customers who have bought pre-paid credit are likely to place multiple orders with them.

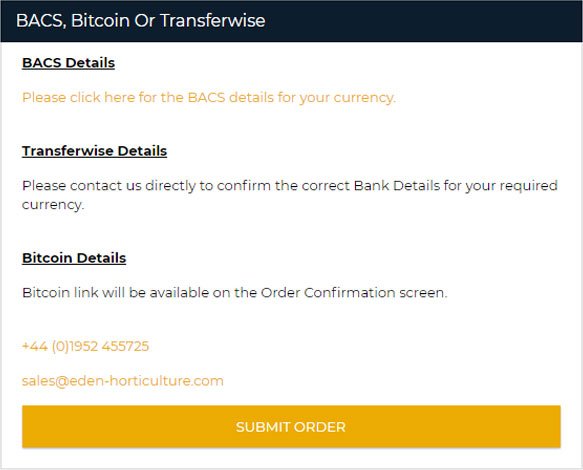

Crypto Currency

Crypto currencies such as bitcoin are slowly moving into the public domain and some ecommerce sites such as Eden Horticulture offer them as a form of payment. Most merchants probably won’t rush to accept any crypto currencies in the short term but they could be worth considering as they grow in popularity.