UX Lab - making sense of VAT in ecommerce

The world of taxation is complicated enough and the application of VAT for ecommerce sites can be a real struggle for some ecommerce platforms to calculate correctly. There can also be issues around how those calculations are displayed to customers which can cause further confusion.

Let's have a look at how some of the issues can manifest themselves, and how tradeit has been designed to try and help mitigate them.

What is VAT?

Value-Added Tax (VAT) is a consumption tax on goods and services that is levied at each stage of the supply chain where value is added, from initial production, to the point of sale. The amount of VAT the user pays is based on the cost of the product minus any costs of materials in the product that have already been taxed at a previous stage. In the UK, the standard rate of VAT is 20%, but there are also reduced rates of 5% and 0% for certain goods and services, and for different locations.

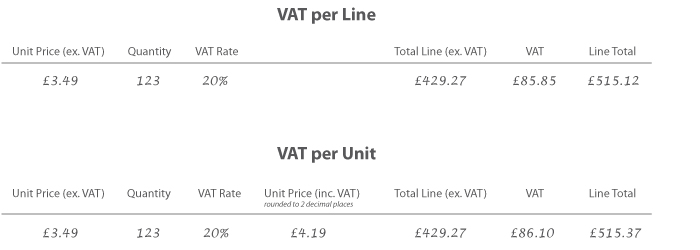

VAT per unit vs VAT per line

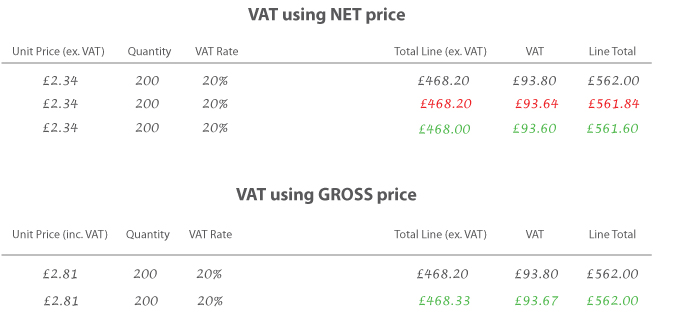

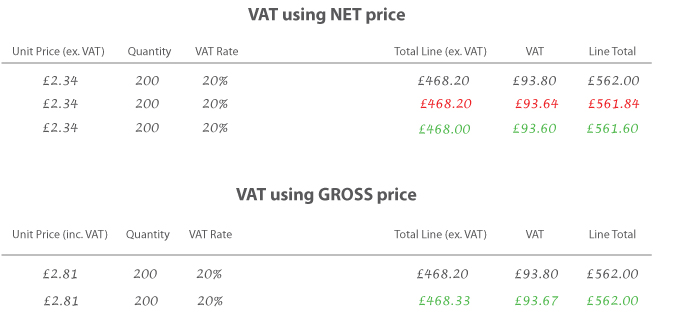

The two most common ways of calculating VAT within an order are per unit or per line, but as the calculations below show, these two methods will return different results.

As you can see in this particular example, when using VAT per Unit there is a 25p difference in the total value which the customer ends up paying. Now, that on its own isn't ideal but a merchant may think it's not that big a deal. However, most ERP systems calculate VAT per Line so if orders are exported into it with VAT calculated on a per unit basis it creates huge problems as the ERP would be calculating a different VAT figure on orders.

tradeit calculates VAT on a per Line basis as per most ERP systems. However, some ERP systems calculate VAT on a per order basis in which case, via implementation, tradeit can be configured to calculate VAT per Order.

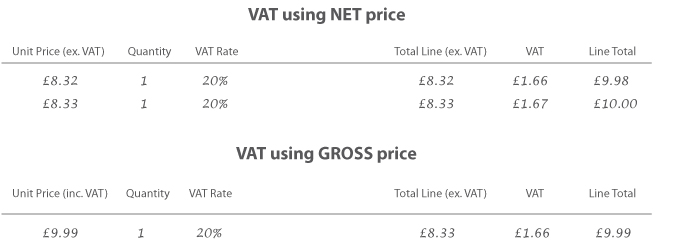

Net vs Gross pricing

Another dilemma revolves around the use of NET or GROSS pricing and how that is output on the site. For instance, in the basic example below, the line total of an order will differ depending on whether you are using NET or GROSS pricing.

Although the difference is minimal it would be more obvious with larger quantities and the application of rounding to 2 decimal places. Whilst this example is anecdotal, this could potentially create a barrier to ordering given the psychological effect of £9.99 vs £10.00.

Given this, we would always recommend using NET pricing for B2B sites and GROSS pricing for B2C sites. In fact, Google insists that public facing sites (i.e. ones that don't require login to see pricing) MUST output GROSS pricing. We would also highly recommend staying away from the option of toggling pricing between inc. and ex. VAT on a site as this can starkly display these issues to customers.

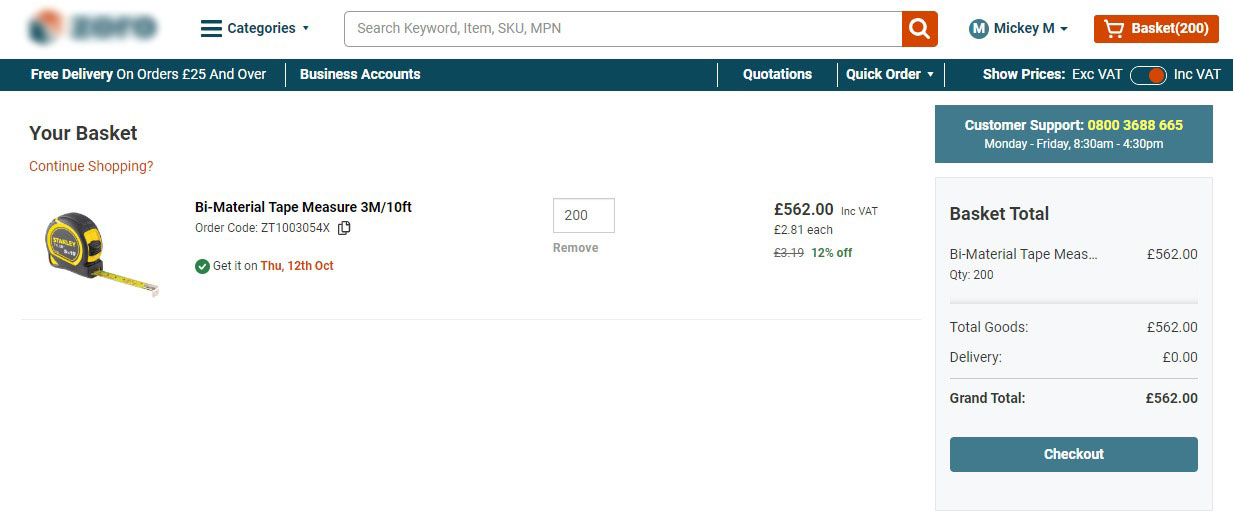

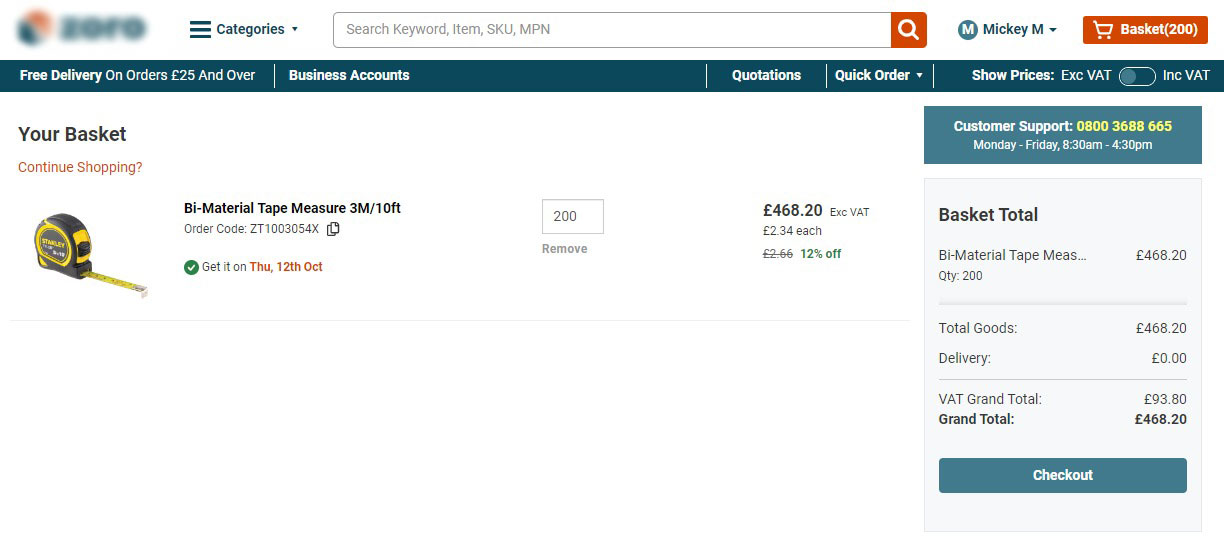

For example, this site sell a measuring tape with a unit cost of £3.19. However, this drops to £2.81 per unit if you order a certain amount (they offer a quantity-based discount which is great). So, for example, if we add 200 to the basket the total cost inclusive of VAT is £562.00. So far, so good.

Basket page showing items inclusive of VAT.

However, if we use their toggle and display that same basket exclusive of VAT we are shown a total for the goods of £468.20.

Basket page showing items inclusive of VAT.

Now, if we break down how those numbers are arrived at, things start to become confusing.

If we start with their NET figure of £468.20, we've immediately hit a problem as the total line cost should be £468.00, not £468.20 (see line three in green). So let's suppose we use their figure of £468.20 for our calculations (even though it's wrong) and we add the VAT, the line total comes to £561.84 (see line two in red) which is again different to their line total of £562.00. It's not helped by them displaying the grand total as £468.20 (without any VAT applied) but showing the VAT as £93.80. So all of the figures quoted are incorrect and the grand total seems to imply that no VAT will be applied so they might inadvertently be giving everybody who orders ex. VAT 20% off their order. This remains as you move into the basket although we didn't checkout to find out if it takes the ex. VAT figure as payment.

Now let's look at it the other way around and examine the GROSS price. So, as we said earlier, if we take the Unit price inc VAT of £2.81 and multiply by 200 units we do indeed get to £562.00. However they've chosen not to display the VAT although their figure of £93.80 previously displayed is actually incorrect and the VAT should be £93.67. As you can see, the whole thing is a bit of a mess.

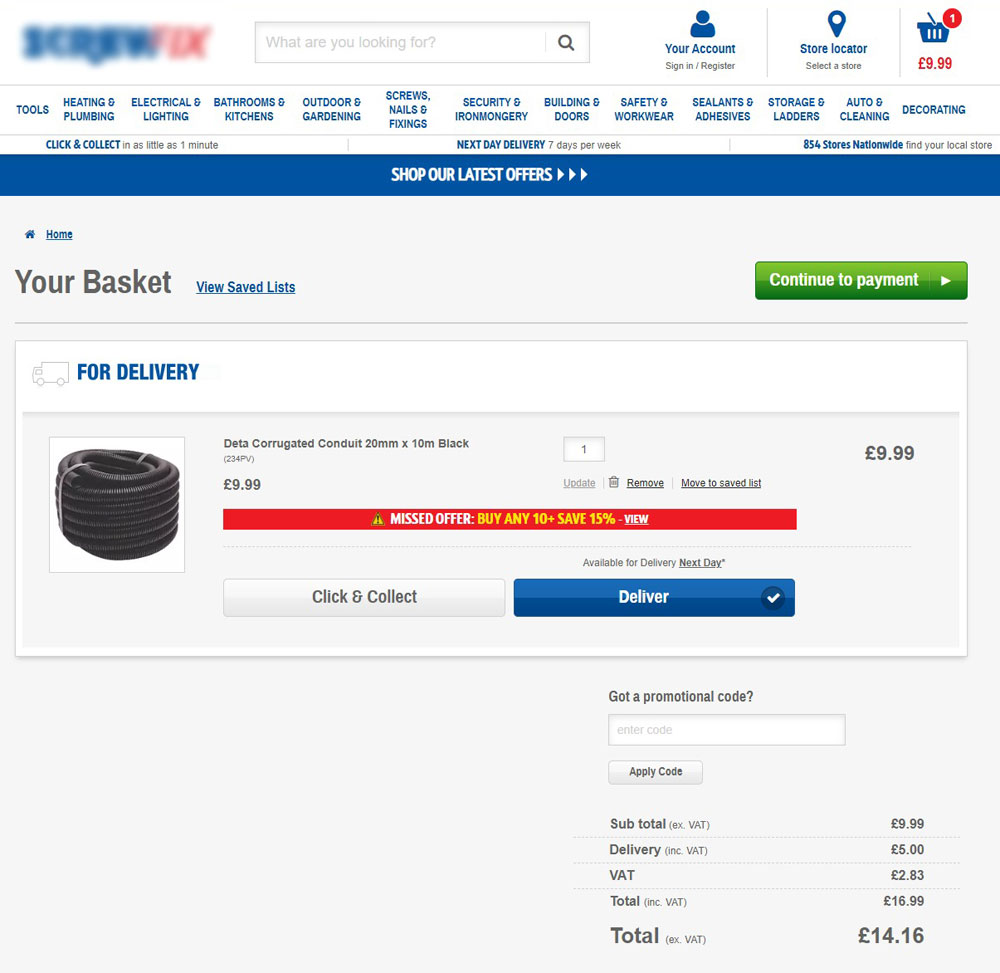

Other sites are no better when the costs are broken down and displayed to the user. For example, although this site is applying the correct figures, the way they are displayed to the user is very confusing. The total cost of the goods and delivery is correct at £16.99 but the way the figures are labelled is confusing as the unit is shown ex. VAT and the delivery cost is shown inc. VAT, but the VAT total below accounts for VAT on both the unit and the delivery. It would make much more sense to show the unit cost ex VAT, delivery cost ex VAT, the total VAT for both combined (i.e. the total VAT on the order), and then the total cost, but it's easy to see what a minefield it can become.

Different VAT rates

Another complication that can occur with VAT is applying different rates based on the items or the delivery location. For example, Children's Clothes are rated at zero VAT, whilst delivery to the Channel Islands or Isle of Man are also VAT exempt.

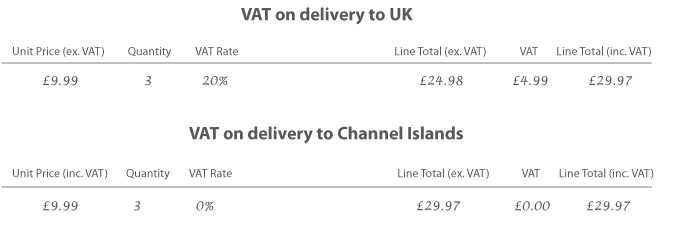

Where a product is zero VAT rated, that is easy to apply, but for items that are being shipped to another country or territory (which is zero VAT rated) things become more complicated. If we take the Channel Islands as an example, most merchants will adopt a really simple approach based on the delivery address. They will then just output the Total Price to the customer with the VAT rate not displayed so they can charge the same price for both Mainland and non-mainland deliveries and pocket the extra money applied to non-mainland orders as in the example below. The best way is to reduce the unit price by removing the vat element (aka 20%).

VAT rates on promotions

The last thing to consider when calculating VAT rates is applying promotions. Now, if the promotion applies to a SKU, then it's really simple as VAT is just calculated against the discounted price and most ecommerce platforms will output that without any problem.

However, calculating VAT for orders with discounts can be challenging. If the discount is applied to the entire order, the VAT will be incorrect for each line item. To address this, the discount can be split across each line item, but this does not account for line items that are not part of the promotion and are therefore not eligible for the reduced VAT rate. tradeit solves this problem by splitting the order discount across only the line items that are part of the promotion and applying VAT to those items only. If the calculation does not divide evenly, the VAT can be rounded to one of the SKUs.